Real estate investment

Investing in real estate

I will take care of your investments. Assessment of the situation, recommendations, search for property, organization of transactions, search and selection of tenants. If required, our network of handymen can take care of property improvements or installations. And it is possible to transfer the lease administration process to partners.

Steps of investing in real estate

Investing in real estate is a responsible and binding decision. Therefore, first of all, you need to assess your investment objective, financial capabilities, financing options, strategy, time allocation, expectations and assets to be purchased.

Depending on the chosen strategy and expectations, it is important to choose the most suitable property for investment. After evaluating the return, the possibilities of raising the value of the property, the potential of the increase in the price of the property, taxes – you can choose the best option according to the current situation. Investing involves numbers, not emotions.

Cash flow comes from tenants paying rent. Therefore, it is very important to choose reliable tenants who will cause as little trouble as possible, pay the rent on time and take care of the property. Depending on the scale of the investment or available time, agencies can take care of property administration.

ADVANTAGES OF INVESTMENT IN REAL ESTATE

Value growth

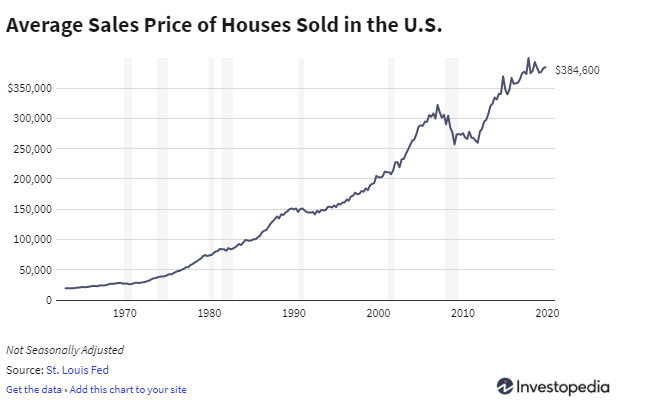

Historically, real estate prices rise by an average of about 3% per year. And according to the Center of Registers, the price of apartments in Vilnius has increased by over 10% on average in the last few years. Although real estate price cycles are inevitable and price fluctuations occur, in the long term the price of the property only increases.

Increase in rental prices

Rents are also always on the rise. And rents remain more stable compared to property price fluctuations. Since 2007 (including the 2008 real estate crisis), rent prices in Vilnius have simply doubled (according to Eurostat data).

Cashflow

Compared to other investments (such as investing in shares or gold), the huge advantage of investing in real estate is the immediate monthly cash flow that can be used for living, as well as for further capital accumulation or reinvestment

Leverage

Only part of the money from the total value of the purchased property may be enough to purchase real estate. Because creditors treat real estate as one of the most liquid collaterals and lend even up to 80% of the property's value, so when buying real estate, 20-40% of your own money may be enough.

Inflation

For this type of investment, the average annual inflation of 2% has a positive effect (inflation has recently exceeded 10%). After all, you borrowed money that depreciates over time, meaning your debt gets smaller and smaller just because of inflation. This is a great way to protect your existing money as well. The same 100,000 Euros will be worth almost twice as much less after 30 years according to the average inflation rate.

Liquidity

Properly purchased real estate is extremely liquid. If you need to sell and get your money back, the process won't take long, especially if you have experience in selling property or using the services of professional real estate brokers. On average, it takes about a month to sell an apartment, but it is also possible to sell it in a week or a few days.

FAQ

Frequently asked questions about investing in real estate

In this case, you will not sell the property, but will continue to rent it until prices recover. History shows that in the event of a crisis or a drop in real estate prices, rental prices remain much more stable, because then housing affordability drops significantly and people simply have no choice but to rent. Housing is one of the most essential human needs, which is why investing in real estate is considered one of the safest ways to invest.

Investing in real estate can be done in various ways: buy and sell, buy and sell after improving the condition, or otherwise speculate on the property. However, I am a proponent of sustainable and long-term real estate investing. Speculating on assets will usually give you higher returns in the short term. But you’ll have to repeat that step many times, and there won’t be any lasting value. And when speculating on property, you need to have a lot of knowledge, and the more transactions you make, the more likely you are to experience a loss (if you do not accurately assess the value of the property, see defects, encounter legal problems when changing the purpose or performing other legal or technical actions). When investing in liquid assets with a long-term perspective, you can focus on cash flow – income. Knowing that the value of the property has risen at least 3% per year throughout history, and that rental prices are also rising, you will be able to create a sustainable and growing income in the long run. In addition, when investing in this way, bank financing options can be used. If the bank currently lends money from 2% (to natural persons), the average annual return on the property reaches 5% (not counting the increase in the value of the property). Also, the bank treats rental income as sustainable income, which will allow more borrowing in the future. Of course, there are many nuances, but generally speaking, investing in real estate with a long-term perspective will increase your cash flow, property income, property value, and total capital. Until finally you can achieve such a cash flow – which will not only cover all your expenses, but also allow you to invest even faster. It is also called financial freedom or independence.

The earlier you start investing, the sooner you can reach your financial goals. After all, it is not called investing for nothing. Investing is the employment of your money, so that money starts working for you in the long run. Therefore, in order to have real estate investments, you need to have your own money and income. If you already see that your work or business is generating money that you manage to save, it would already be a signal that it is high time to think about planning your money employment.

There are many risks:

Poor choice of property for investment (overpaid for the property, lower than average return generated, hidden property defects, underestimated property improvement costs).

Irresponsibly selected tenants, which can cause not only financial damage, but also a lot of stress.

Overestimated their financial capabilities when investing, which can cause a lot of inconvenience and stress in the future if bank interest rates rise or other unforeseen things happen.

Poor financing conditions are chosen, which can turn an investment into a liability.

Illiquid assets can cause problems when you want to liquidate your investment and get your money back, especially if you need to do it quickly.

About me

Hello, my name is Dominic.

I’m glad you visited my page.

I am interested in the real estate market, construction, investment, trends, sales art. Over the past few years, my interest in real estate has evolved into many different transactions. And with each contract, the desire to delve deeper into the real estate industry and learn more and more.

I have rented apartments for short-term rent, rented apartments/commercial premises for long-term rent, bought/sold apartments, lofts, cottages, commercial premises, plots. I also have experience selling semi-finished properties from a developer. And after successfully performing more than 10 repairs/installations, I gained important technical knowledge.

I can assist you in making quality real estate investments.

Experience

How are real estate prices changing? What has history shown us? What are the trends? What can we expect in the future? How are investments in real estate different?