Real estate is one of the most popular asset classes in which not only experienced investors or large funds invest, but also people without much experience.

In this post, I want to talk more about investing in real estate, how these investments differ from others, what to pay attention to when investing, numbers, trends and other nuances.

Advantages of investing in real estate:

Growth in property value

Increase in rental prices

Cash flow is received

The principle of leverage

Credit crunch

Liquidity

Inflation

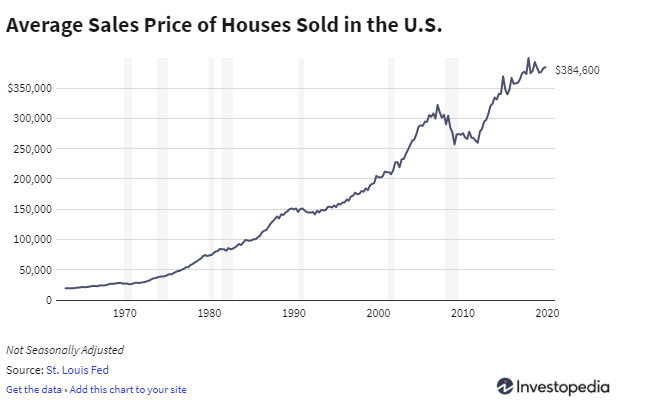

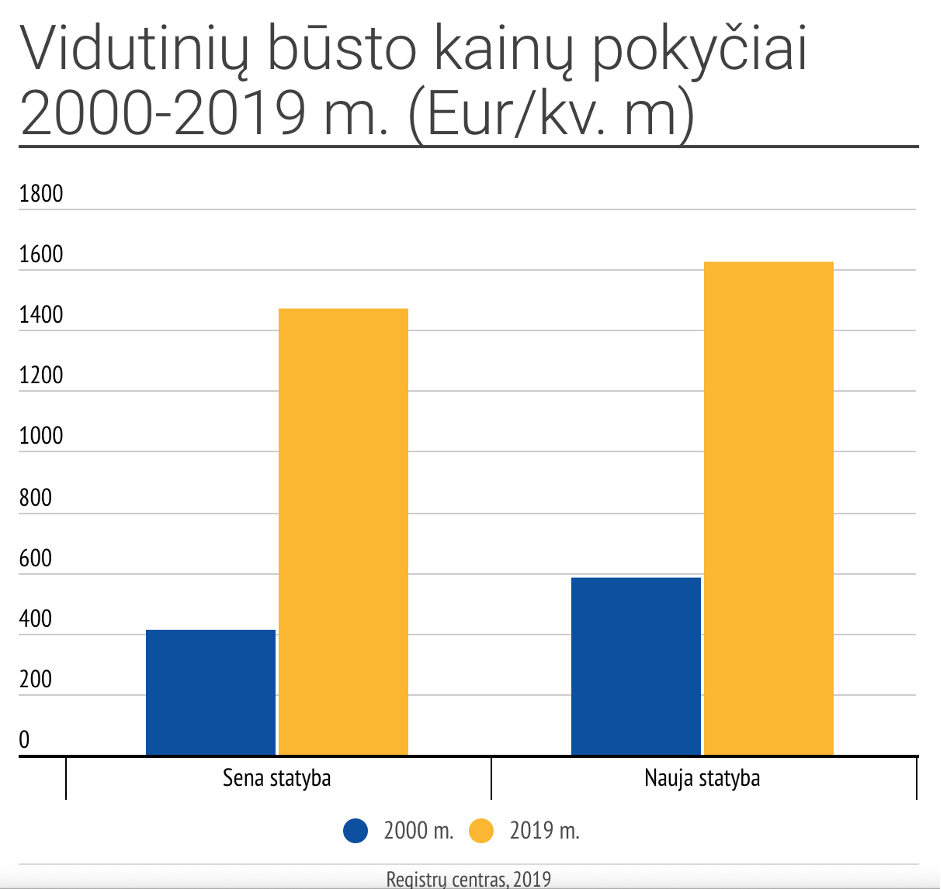

Real Estate Value Growth

Historically, real estate prices rise by an average of about 3% per year. And according to the data of the registry center, housing prices in the big cities of Lithuania have risen by an average of 5% in the last two years – in 2018, and even 7% – in 2019. Although real estate price cycles are inevitable and price fluctuations occur, in the long term the price of the property only increases.

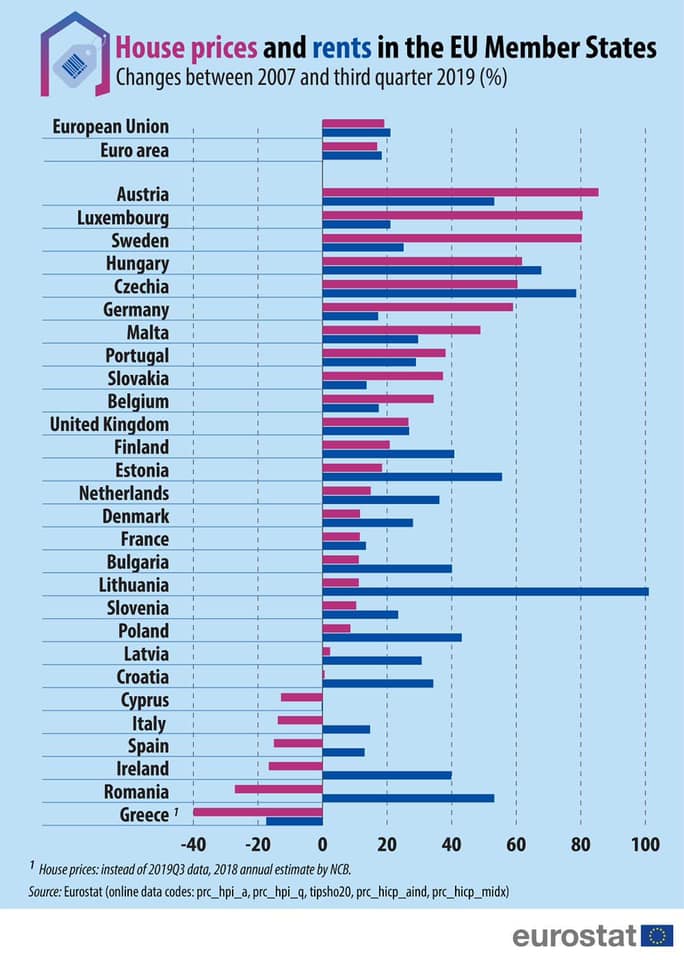

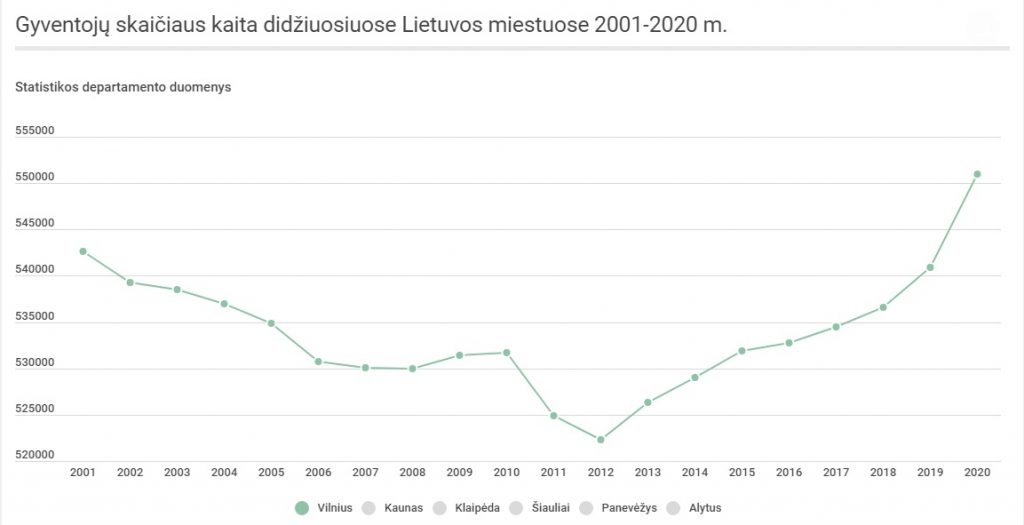

Real estate rental price growth

Rent prices are also a very important variable. In prosperous cities, rents keep rising. It depends mainly on demographic indicators, urban development, standard of living. Specifically in Vilnius, apartment rental prices have literally doubled over the last 10 years (according to eurostats data). And observing the demographic indicators, the population in Vilnius has been growing for a long time. When calculating the return, the growth factor of rental prices in the long term changes the number strongly to the positive side.

Cash Flow Received Every Month

Compared to other investments (such as investing in shares or gold), the huge advantage of investing in real estate is the immediate monthly cash flow that can be used for living, as well as for further capital accumulation or reinvestment. The average annual return on investment in real estate in the city of Vilnius is about 5-6% before taxes. However, in the long term, returns are higher due to inflation, property and rental price growth.

The Leverage Principle

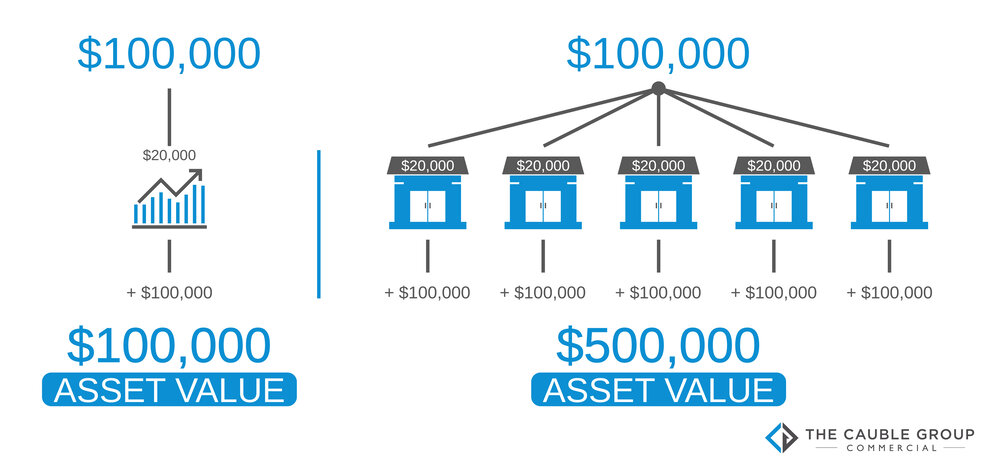

Real estate is probably the most expensive thing in the daily market. Therefore, few can afford to buy property only with their own money. Even those with money, but more experienced investors, use the principle of leverage. This means that they do not use their own money, but borrowed money, usually from a bank. This means that if you have, say, 100,000 Euros, you can buy one property unit by paying for it in full, or even 5 property units by using the money borrowed from the bank. In this case, the value of your real estate portfolio would not be EUR 100,000, but EUR 500,000 (theoretical example for explanation). Banks treat real estate as one of the most liquid collaterals and lend up to 85% of the property’s value, so 15-20% of the down payment is enough when buying real estate. Of course, there are strict requirements for the borrower and there are other nuances. However, this strategy is used in practice by the majority of investors.

Credit Decline

By using the principle of leverage and borrowing money, the credit (debt) for the property decreases with each month, because you pay the bank a monthly payment (for interest and credit), and the tenant pays you rent. So the credit keeps getting smaller and smaller, which means that you own more and more assets every month. And the value of the property continues to grow, regardless of whether you bought the property with your own money or borrowed money. The difference between the potential sale price of the asset and the credit balance is also called the margin. The margin can also turn into your earnings from the sale of the property.

Liquidity

Properly purchased real estate is extremely liquid. If you need to sell and get your money back, the process will not take long, especially if you have experience in selling property or using the services of professional sellers – real estate brokers. On average, it takes about a month to sell an apartment, but it is also possible to sell it in a week or a few days.

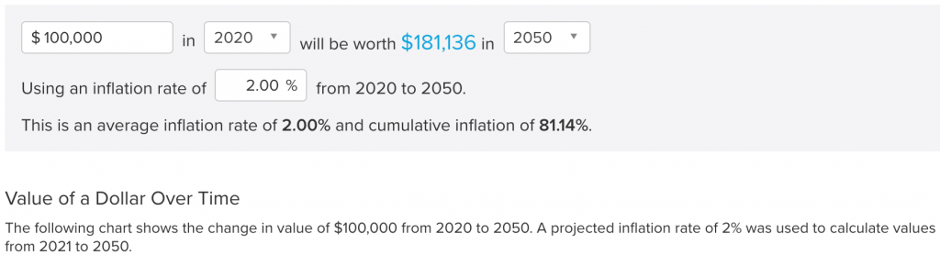

Inflation

An average annual inflation of 2% has a positive effect on this type of investment. After all, you borrowed money that depreciates over time, meaning your debt gets smaller and smaller just because of inflation. This is a great way to protect your existing money as well. Example: the same 100,000 Euros will cost almost twice as much after 30 years according to the average inflation rate.

Risks and Negative Factors of Investing in Real Estate

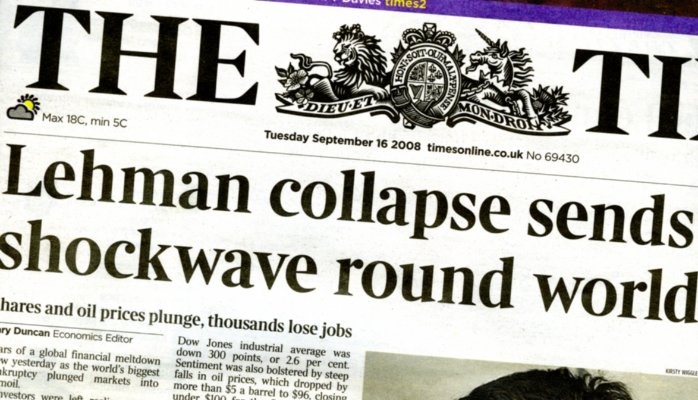

And now let’s talk about risks and negative factors. Based on historical facts and economic history, as far as we have information to date, it is clear that the economy has been constantly fluctuating and on average every 10 years or so the economy has experienced a recession or crisis. This happened both on a national scale and on a global scale. This is inevitable and will continue to be so in the future. It is also clear that the real estate market is one of the largest markets in the world and is inevitably affected by economic fluctuations, even when it is not related to the real estate market. And one of the biggest financial crises occurred in 2008, when after the collapse of the Lehman Brothers investment bank in the United States, other banks began to go bankrupt and the crisis turned into a global financial crisis.

This happened because of the irresponsible lending of money by the banks for home loans without a down payment, which caused a mortgage collapse and people were unable to repay their loans on a large scale – the real estate market automatically collapsed and property depreciated by 40-50% almost all over the world. This was directly related to the real estate market and it was the biggest drop in real estate prices in history. Looking at it now, real estate prices have almost reached the record price level that existed before 2008. Well, now the world is struggling with the sudden global pandemic of Covid-19 and while I am writing this text, it is difficult to predict how much it will affect the real estate market.

Although it is virtually impossible to predict the real estate price cycle, it is clear that there will be fluctuations. On the other hand, it is also clear that throughout history the price of real estate has only risen and will continue to rise, with some downturns associated with economic fluctuations. Therefore, in the long term (10-30 years), the invested money will only grow. The only question is at what pace. Since the amounts involved in investing are large, you need to assess your financial stability very responsibly. Although the world and the banks have learned from their mistakes and introduced safe lending rules requiring a down payment and proof of stable income, to protect yourself, you should have at least a 20-40% “financial cushion” (20-40% of your money when investing) when investing, which will allow you not to experience extremely painful losses, and in this unpredictable world, even in the event of a major crisis, it would be possible to survive without great stress or loss during a difficult period.

Despite all calculations, economic, returns and other indicators – real estate, or in other words “a roof over your head” – is one of the most basic human needs. That is why investments in real estate are one of the safest and most reliable investments. And the monthly cash flow that is stable and growing over the long term creates a huge advantage over other investment tools. And investment control, creativity and liquidity impressed many investors. If you understand why you need to invest, real estate should occupy at least part of your investment portfolio.

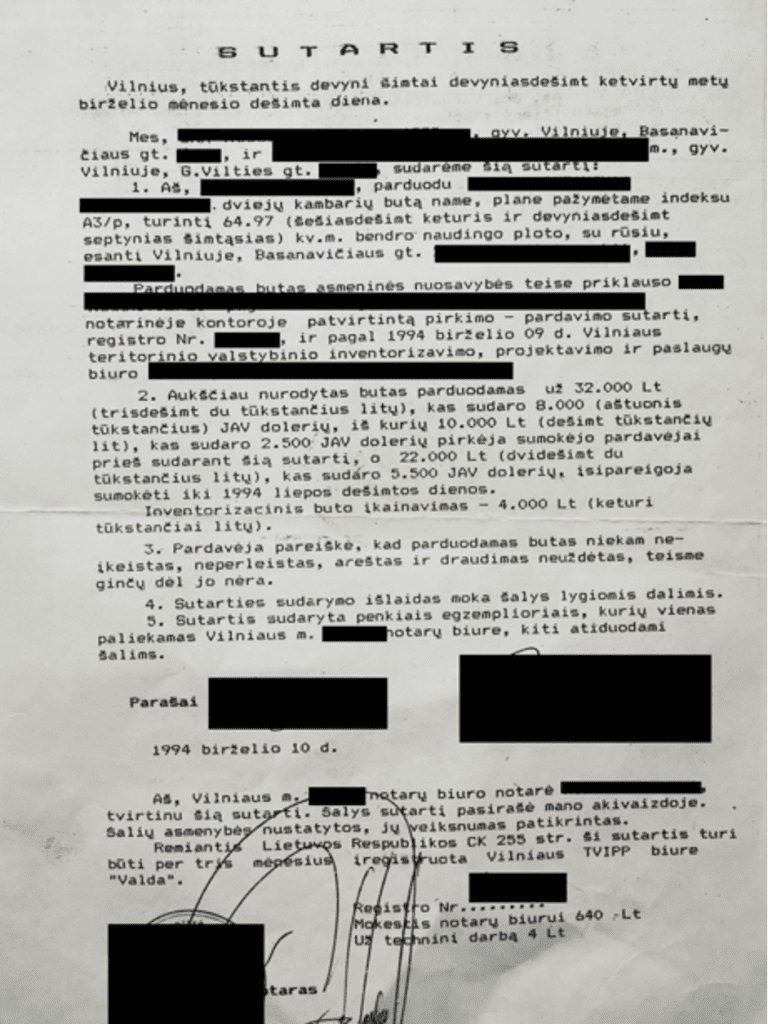

Bonus – original photo and contract from 1994. ☺ And how much would such an apartment cost not in 1994 (32,000 litas), not in 2020 (about 130,000 euros), but in 2040…? ☺

Contact us if you are interested in investing in real estate.

If you have more questions, I will be happy to answer them. And if you liked the content I create and find it useful, I invite you to become friends on social media so that you don’t miss useful information, advice or investment examples.