Rent or buy?

Probably, each of us has thought about the possibility of buying a home. Unfortunately, this often remains only a consideration, as many questions arise. Is it really worth buying if you can rent? What amount to allocate? Where to look for information? In this post, I aim to answer these questions and help you make a decision about buying your home.

Own housing – an investment or a liability?

We often hear that your own home is the best investment. However, this is not always true. In simple words, an asset becomes an investment when it earns you money, and a liability when it incurs expenses.

For example, it is common to think that a car is a classic example of a financial obligation. However, if you work as a driver or rent a car, assets generate income rather than expenses. Thus, any asset can become either an investment or a liability, depending on whether the asset earns money or only generates expenses. Therefore, when buying your home for life, you need to understand that it is primarily a commitment, not an investment.

According to the requirements of the Bank of Lithuania, monthly payments for financial obligations cannot exceed 40% of income. In the case of housing purchase, it is a payment for a loan, which consists of interest and credit coverage. For example, if your monthly salary is 1 thousand. eur., the payment cannot exceed 400 eur. per month. It is important to know that financial obligations are calculated in total. If you are currently also paying for a leased car or have a consumer loan, the total amount of all liabilities cannot exceed the same 40%.

However, 40% is a dangerous limit. If you lose your job or other life circumstances change, the loan can become a heavy burden. Therefore, in order for the purchased home to become a smart financial decision, the monthly payments should reach up to 15-30% of your income.

Irrational fear of loans

A home loan still scares many potential buyers. One of the reasons for this is thinking that after taking a loan, the property will belong to the bank. The reality is the opposite – when the bank finances the purchase of real estate, the object is mortgaged according to an additional mortgage agreement.

Generally speaking, this means that you become the owner of the property and can dispose of it as you wish: repair, sell, rent or leave it empty. The most important thing is to fulfill the obligations specified in the bank loan agreement, which is signed by both parties.

If the obligations are not fulfilled for about 3 months, the bank can start legal proceedings during which the loaned money will be recovered. However, even in this case, it is not prohibited to sell the house and repay the debt. The bank’s property is the money lent, and the property it buys is just a guarantee that the customer will fulfill its obligations. When the opportunity arises, you can pay off all remaining credit at any time without penalty (usually) and keep the property for yourself.

Home buying math

Let’s imagine that you want to live in an apartment whose value is around 100 thousand. euros and you are considering whether to buy or rent a home. In this particular case, the rental price would be approximately 450-500 euros per month. When buying this home, an initial deposit of 20,000 would be required. euro or 20% of the value of the object. The bank would finance the remaining amount – 80 thousand. euro with 2.2% interest based on today’s average. The monthly mortgage payment for a period of 30 years would amount to about 304 euros. per month. After deducting the initial deposit, 150-200 euros would remain in your bank account every month. more.

However, it is important to know that the value of your property will increase with each month. According to data from various sources, housing prices increase by an average of 3% per year. Here, over the last three years, the price of housing in Vilnius has risen by about 5% annually (according to data from the registry center and ober-haus).

As you make monthly payments, the difference between today’s value of the property and the debt, otherwise known as the margin, would also grow. If you decide to sell the home, this would be the money that remains with you.

Fig. 1 Margin growth

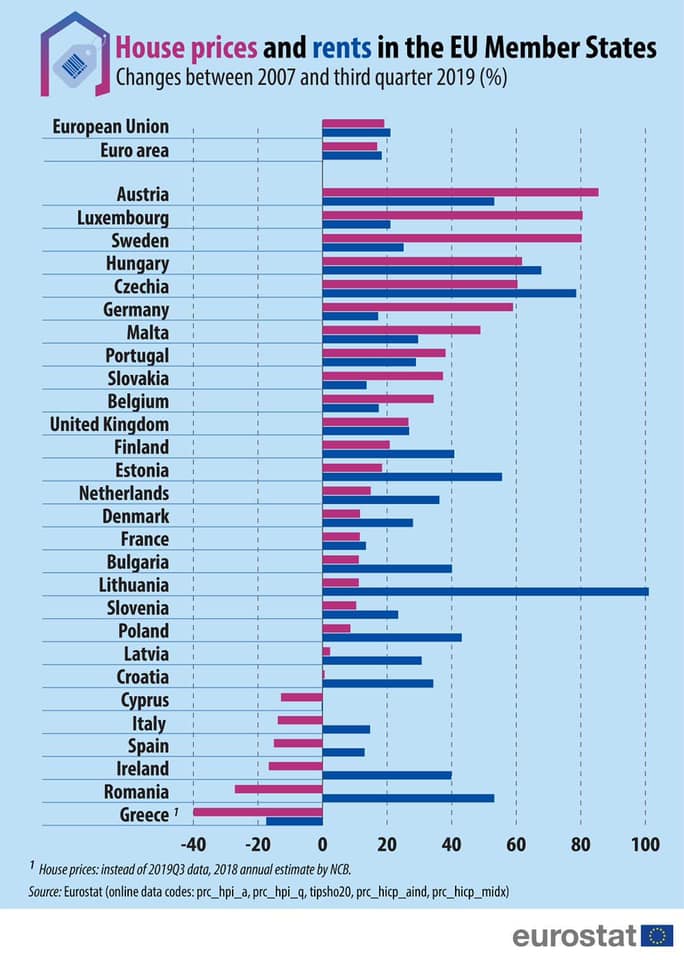

And these are not all the advantages – housing rental prices rise by an average of 2-4% per year. In Lithuania, this trend is particularly pronounced – over the past 12 years, growth has reached 100%, including the 2008 financial crisis.

However, real estate price fluctuations are inevitable. If you buy a home during the upswing of the price cycle, the chances of losing are high. However, the data also shows that the investment will still be positive in the long run.

Now let’s imagine that you decided to rent the same house for a period of 5 years. Annual expenses would amount to 5.4 thousand. eur., and within 5 – at least 27 thousand. euro Provided that the lessor does not raise the price, which tends to increase in the market. This amount is income to the owner of the property, which does not create any lasting value for you.

If you owned the house, you would pay 18.24 lakhs in 5 years. euro loan payments, and at an average of 3% growth in value, the value of your property would rise to approximately 116 thousand. euro Also, in 5 years the debt would decrease by about 10 thousand. euros. Summing up, we see that after making a decision to buy a house, the cash flow during this period would be 8.76 thousand. euro greater than the one renting. Finally, an additional 26 thousand would appear in the asset balance. eur., which represent the price of that day’s asset value minus the credit balance. And 20 thousand The eur down payment would also not disappear anywhere.

Luxury now is the price of the future

Naturally, another question may arise – if the value of the property tends to rise and the credit balance decreases, why not buy a home above your means?

It is important to understand that you will get the margin only after selling the property. As long as the property is lived in, the property will also need to be maintained in order to preserve its value. The loan and maintenance costs should not become the main monthly expenses. The more money left in the account after all obligations are covered, the calmer and more stable you can feel.

Unfortunately, in reality, a different scenario is more often seen. People tend to buy assets beyond their real means. After all, you need not only housing, but also a car, a budget for children, clothes, travel and entertainment. It is so easy to get stuck in a vicious circle, when you are the last to try to cover all your obligations by the end of the month, without getting enough income, without saving or investing for the future.

Why should you choose to rent?

You are probably thinking that the rent is even more expensive. In fact, mathematically, the rent will often outweigh the mortgage payments. But money is not the only factor. It is important to understand that renting a home is a very small legal obligation compared to a home loan. If your life circumstances change or you lose your job, you can rent a cheaper apartment as early as next month.

It is also important to pay attention to the fact that after purchasing your own home, it will not be possible to change it easily and the whole process may take several months. Therefore, if you have not decided whether you want to live a sedentary life, the purchase of a real estate cake should be postponed for some time.

Renting an apartment has other advantages. One of the main ones is that you don’t have to take responsibility for property or household appliance failures. Real estate inevitably requires additional investments – household appliances do not last forever, furniture breaks, and buildings wear out. Eventually, problems arise with roofs, pipelines or other communications. While you are renting the property, all of this is the owner’s responsibility.

So, the answer to the question, whether to buy a home or to rent, is actually quite elementary. Buying is unequivocally worthwhile if it is a smart, balanced investment based on opportunities and needs. If you live a sedentary life, feel secure about your career and sources of income, maybe it’s time to think about owning your own home?

If you have more questions, I will be happy to answer them. And if you find the content I create useful, I invite you to read more on social networks.